Entering Supplier Invoices

You only need to enter supplier invoices in Quant if you do not pay your suppliers straight away. For example, if you bought stationery from a shop and paid instantly then you would not enter a supplier invoice. You would just process this transaction through Banking.

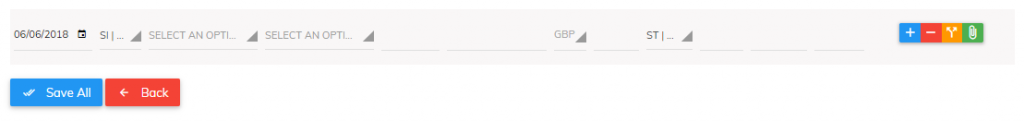

To enter a supplier invoice in Quant simply go to Enter Transactions > Suppliers > New > Invoice. You will then be able to enter the details of your invoices, as shown below:

For each one you should enter the date on the invoice, select the supplier who issued it to you (you can add the supplier if they are not on the list), the appropriate expense category, the reference on the invoice (usually the invoice number) and the net amount (amount before VAT is added).

Please note: If you specified in the initial wizard that you are not VAT registered you will only see the total amount field with no reference to VAT.

If you are VAT registered, there are three different VAT codes you can use on your invoices:

ST: This is standard VAT which will be mostly used. This is automatically set at the current rate of 20% but can be edited if some of the services/products you provide need to be entered at the reduced rate of 5%.

EX: This covers services/products you provide that are exempt from VAT or are zero-rated. Examples of exempt sales are insurance and education. Examples of zero-rated sales are food and books.

NV: This covers transactions that do not relate to VAT. You may require this if you sell to countries outside of Europe or use transactions where VAT does not apply, such as payments to employees or loans.

To enter another invoice click the plus button. Once you have finished simply click ‘Save All’.