Recording Mileage

At Quant, we think recording your mileage should be a doddle. That’s why we’re planning to create a tool for both the Quant web app and Quant Mobile which will allow you to record your mileage on the go.

However, in the meantime there are a number of ways you can record your mileage in Quant today.

Limited Companies

If you’re using a personal vehicle for which you’re charging your company mileage, you can record this through your director’s loan account, either per trip or in a daily, weekly or monthly summary.

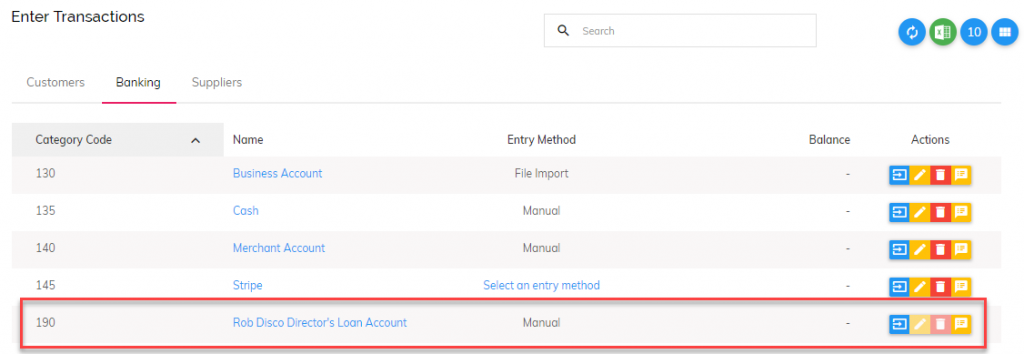

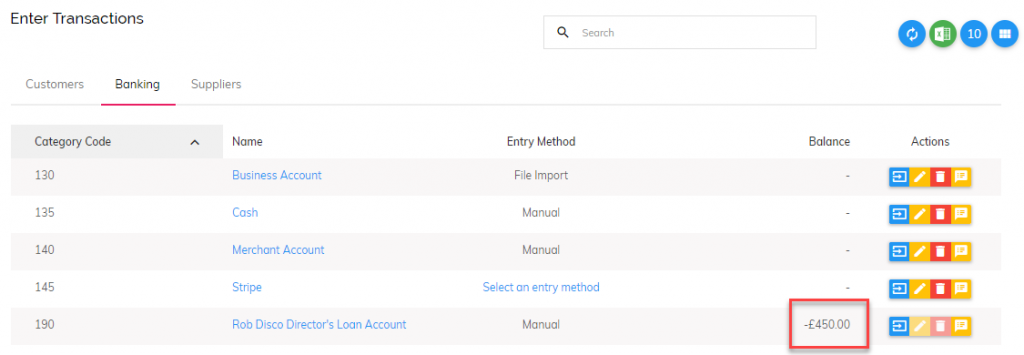

To start keeping track of your mileage go to Enter Transactions > the Banking Tab and click on the ‘Enter Transactions’ icon next to the relevant director’s loan account.

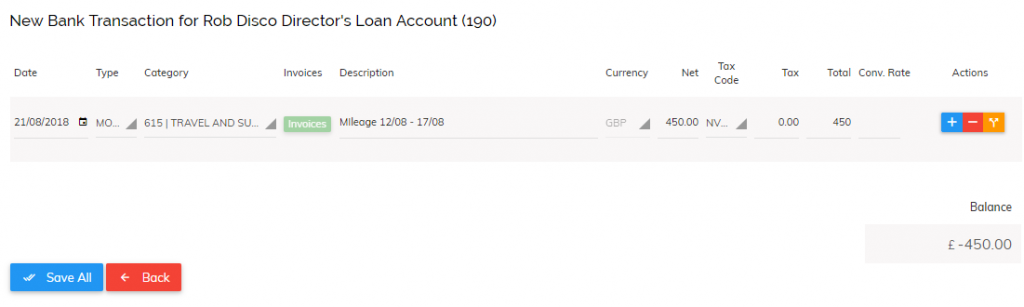

You’ll then need to enter the date of the period end (for example the week end date if you are entering a weekly summary), the transaction type as ‘Money Out’ and the category as ‘Travel and Subsistence’ – or add a new one just for Mileage. You should then enter a description and the amount being claimed for mileage. For example, if you travelled 1,000 miles at 45p allowance per mile it would be £450.

The result will be the company claiming the expense and therefore reducing its profits. The amount entered will now be owed to the director which can be withdrawn tax-free from the company.

Sole Traders/Partnerships

When entering mileage as a sole trader or partnership in Quant the process is slightly different. Let’s take the same example as above of 1,000 miles.

Take the same steps as before by heading to Enter Transactions > the Banking Tab.

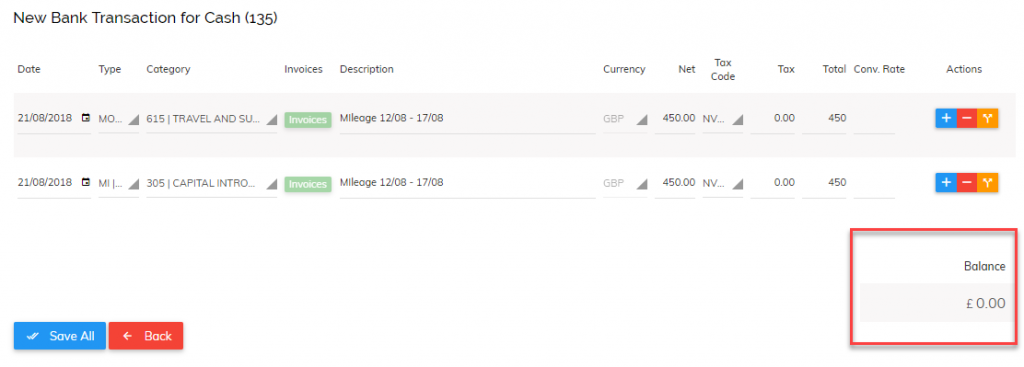

Click on ‘Enter Transactions’ for the cash account. You can then process the mileage claim payment out in one transaction, with another transaction showing the same amount coming in (on the same date), which is categorised under ‘Capital Introduced’.

As you can see from the image, the net effect is zero, meaning the cash account balance will not change. The mileage expense will be included in Quant and £450 will show as introduced from the owner/partner.